Who uses a financial planner?

Our clients come from all sorts of backgrounds, with all sorts of different aspirations, and a vast range of experience in managing money. Some are very wealthy professionals, some are not. Some are excellent at managing their money, some - are not.

However, all of them want expert guidance in building their wealth and choose to receive financial advice because they have neither the expertise, time nor desire to manage their personal finances themselves. They want to spend their time on pursuits and activities they enjoy, rather than using up their free time trying to keep up-to-date with what they should be doing to make the most of their income and investments.

What do we do?

We provide you with financial coaching to make the most of your income and wealth. We want you to have the time to do the things you want to do now, as well as making sure you are on track financially to continue to live the life you want to in the future.

Many people get the general idea of what “financial advice” is, but have no detailed understanding of how it all works. Some people have wondered if we set them a budget? Or buy shares for them? Or take over managing their bank accounts? Handle their insurance? And so on.

What we do for every client is what that client wants us to do and what we agree on. So firstly, we want to understand why you want to seek advice, and then our role is to keep you on track to make sure you get there.

Want to increase your wealth?

When you have the right plan, with the right accountability, wealth creation goals are achievable.

Getting to know you

Your financial goals and aspirations

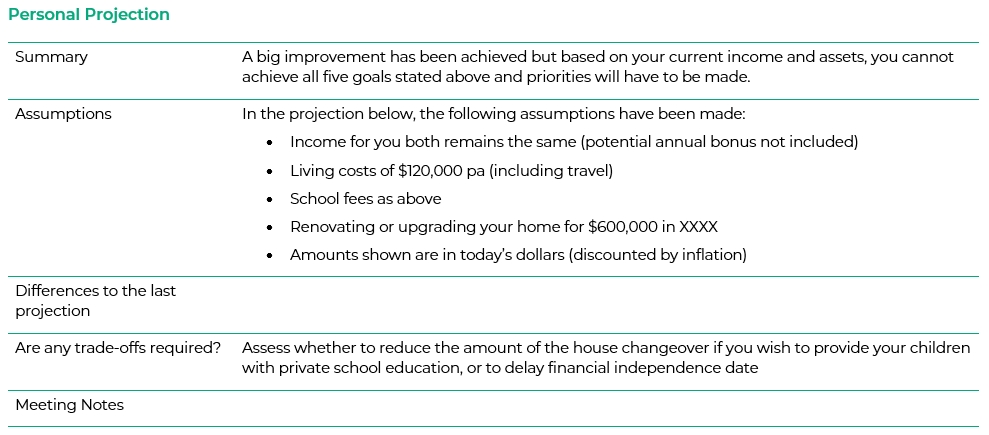

Take a look at the (shortened) example financial goals listed here. In it, you’ll see an (example) clients’ goals and the timeframe in which they want to achieve those. This is an extract from a sample Financial Strategy — one of the first things we do to better understand your financial position.

After we understand your financial goals, we then go through your 'personal balance sheet' — your assets and your liabilities. And now we have our starting point for tracking your financial progress.

Download the sample Financial Strategy

Sample financial goals

-

Buy a new home or renovate your existing home at a net changeover cost of $600,000 (over the next three years)

-

Provide your children with a private school education ($25,000 per child per year over the next 8 years)

-

Repay investment debt of $300,000 (over the next thirteen years)

-

Enjoy your lifestyle including travel (Ongoing)

-

Build an investment asset base to achieve financial independence to support living costs of $120,000 pa (including travel) to maintain current lifestyle ($2,200,000 by age 55, then work part-time for five years)

Excerpt of a personal projection based off sample financial goals

The basics

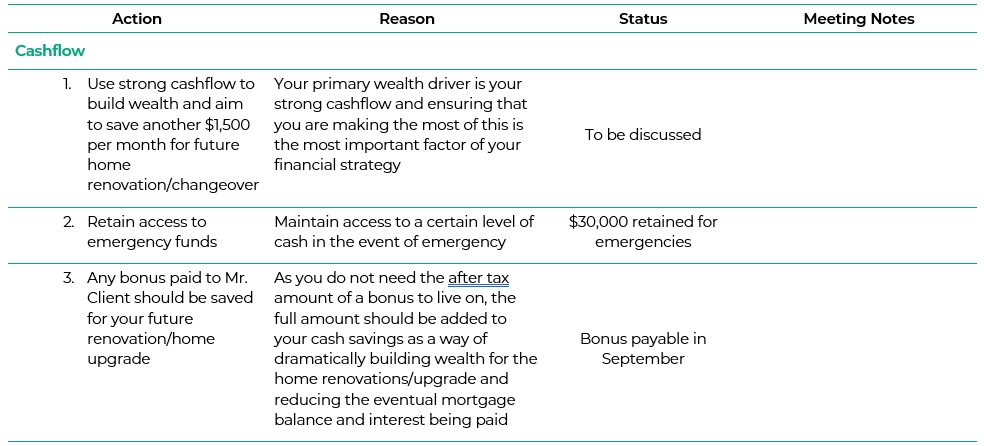

As you work through our sample Financial Strategy, you’ll see we look at everything: your cash flow, wealth accumulation, debt management, tax planning, superannuation planning, investment management, risk management, estate planning, insurances and any other issues we need to discuss to make your goals reality. You’ll also see there’s a place for a summary of the next steps.

Under each of those areas is a series of action points, the reasons for those, the status — i.e., whether we need to discuss it, you need to find out some extra information, whether it needs to be implemented at a later date, or reviewed as part of another process — and notes from our meeting on those action points.

Because financial advice is different for everybody, and there’s no such thing as 'one size fits all', it’s important for us — and you — to know what you’re expecting from it. So you’ll also see a list of areas that our example clients noted as needing to 'happen to call our relationship a success five years from now'.

It's about control

Take the first action point under 'cash flow' for our example clients: we’ll "use strong cash flow to build wealth and aim to save $1,500 per month for future home renovation/ changeover". To make that happen, we might track their cash flow and assess their progress against agreed savings targets.

Moving through the action points in other areas, examples of what we do are:

-

ensure any debt you have is structured the most effective way for your circumstances and future ambitions

-

manage your superannuation strategy so you’re making appropriate contributions, which are invested suitably

-

review your insurance so you and your family are financially protected

-

ensure your Wills and other estate planning documents, such as Powers of Attorney, are up to date and reflect your needs (we can work with your solicitor here)

-

provide specific investment recommendations

-

…and we also handle the administration for all these areas

Not taxing

We’re sometimes asked if we do tax or provide accounting services. We don’t: we purely offer financial planning and financial coaching services.

However, we will work with your accountant where we need to, and the same goes for any other specialist service you may require — legal, insurance, stockbroking and so on. If you don’t have someone you like to work with, in those specific fields, we can refer you to a specialist.

For clients who are looking for a tax adviser as well, we can refer Summerhill Financial Management for integrated tax and financial planning services.

A PT for your finances

We regularly review your goals together, because these may change as your life changes, so we adjust and update as necessary. We find this also helps you maintain your commitment to meeting your financial goals.

As a single woman entering retirement I feel Alexander has given me clear and honest advice about investments and managing my money in general. I have complete trust in him and know he diligently researches the latest financial developments. He is always prompt in replying and gives thoughtful personal attention.

Marina

How do we help you succeed?

Regular catch-ups

All of our meetings are held virtually and have been for years — via web conferencing, Zoom, Skype or Google Hangouts. We do this so Alex can be available to clients regardless of where they are that week. Virtual meetings also have the great benefit of allowing meetings outside ‘normal’ work hours.

The method of catching up doesn’t matter, touching base is the most important thing because it allows us to continue giving you a personal and tailored service for your needs.

Regular updates

We keep our clients updated via regular video updates, articles and other information, on market conditions, important events and useful strategies for managing your money.

Tools to succeed

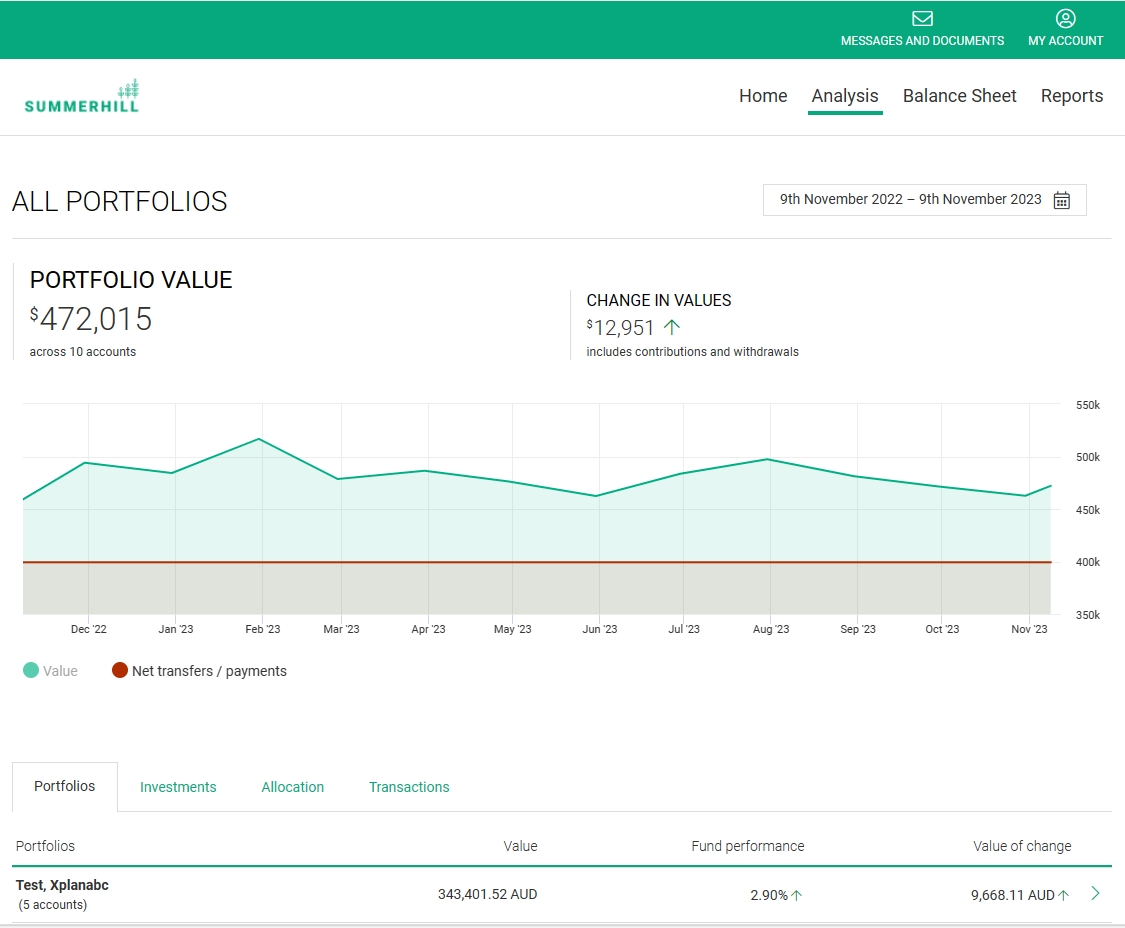

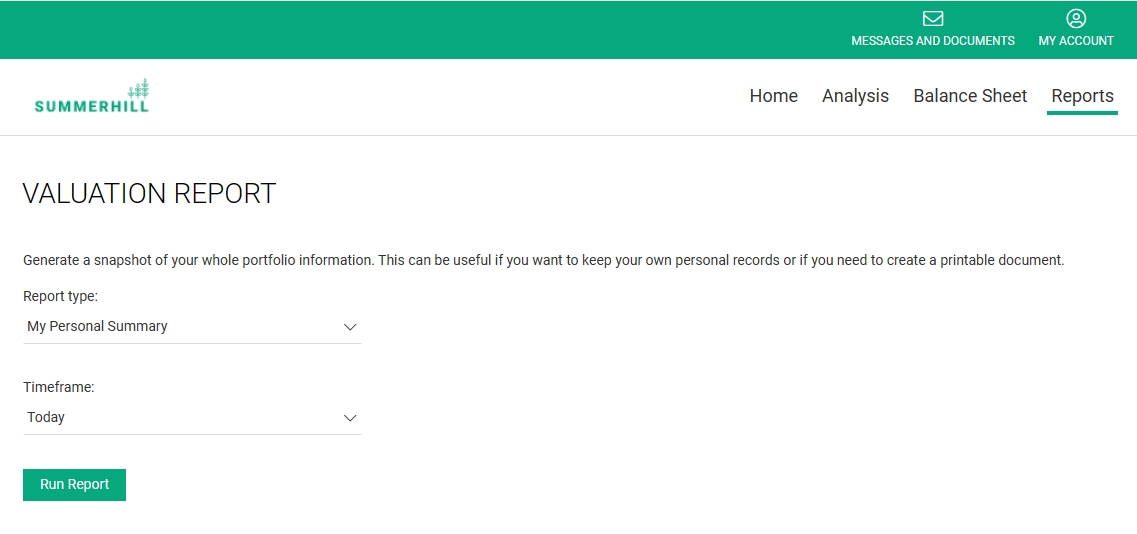

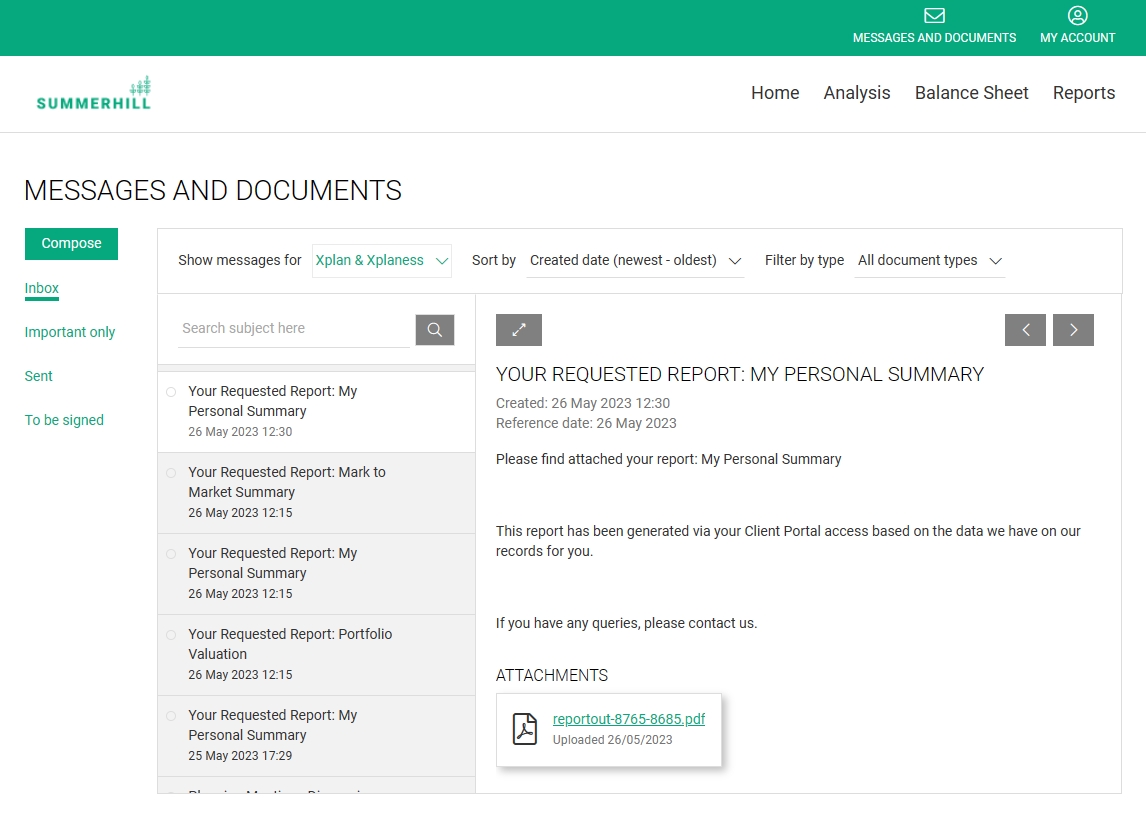

As well as our regular meetings and video updates, we also provide you with a range of tools you can use to manage your finances between meetings. This includes our client login, as well as many others.

Samples

Join our waiting list

We only choose to work with clients who are looking for a long-term partnership. We have a waiting list for new clients, and, given we want to maintain the boutique nature of our business, we choose clients we'll enjoy working with over time.

We also expect our clients to be engaged with their finances: yes, it's our role to provide you with the information on which to base your financial decisions, but this is your money and your life, and we expect our clients to engage with us.

One of the rewards of providing financial advice in this way is seeing the tangible improvement in a client's financial position, which gives them more choices than they would have had otherwise.

You'll find our Financial Services Guide here. It outlines the services we can provide, how we're remunerated, details of any arrangements that may influence our advice, details of our internal and external complaints-handling procedures and how we collect and use your personal information.

Some feedback from our clients

I feel very confident with the advice Alex provides my husband and I. He is always available to answer all our questions while responding quickly. I feel very safe with Alex's suggestions and they're always the right fit for us!

Lora

Alex has the rare ability to make you feel like you’re his only client. In each review, his recommendations are explained expertly and simply, with time to really understand the thinking in how this advice will meet our goals. He’s a big part of why I sleep well at night when it comes to retirement planning.

Sean

Alex is extremely professional, trustworthy, knowledgeable and highly ethical. Alex is very proactive and keeps me on track with my goals and objectives. Alex manages my investment portfolio, providing regular investment & portfolio advice and maintains my insurance policies. I highly recommend Alex.

Renae

Why we'd love you to choose to work with us...

Experienced team, passionate about creating wealth.

You can access your investments 24/7 and watch it grow.

Chat to our team when you need to, so you're not alone.

We give you access to sustainable investing options.

We love travel, so we understand goal setting.